Top 5 on the AEX Index

| Name of Company | Industry | Weight (%) |

| Royal Dutch Shell | oil and gas | 15.27% |

| Unilever | personal and household goods | 15.17% |

| ING Group | banks | 11.11% |

| ASML | technology | 9.5% |

| Philips | industrial goods and services | 5.7% |

An Overview of Dutch Financial Engine – AEX

The AEX index is currently composed of 25 of the best Dutch companies that trade on the Euronext Amsterdam (formerly known as the Amsterdam Stock Exchange).

Started in 1983, the free-float AEX is composed of a maximum of 25 of the most traded securities and is now one of the main national indices of the stock exchange group Euronext, as is the CAC 40 from Paris, German DAX 30, and Brussels’ BEL20.

Are you ready? Make your deposit today, start trading with as little as $250 and enjoy the benefits of trading with a regulated, Canadian broker!

AEX Index Trading information

- MT4/MT5 Symbol: AEX

- Trading Times: 07:00-20:59

- Country: Netherlands

- Currency: EUR

- Minimum Trade Size: 1

- Increment: 0.05

- Exchange: Euronext

Interesting facts about AEX Index

The AEX started off from a base level of 100 points on the 3rd of January 1983. Since 2011, the AEX index is reviewed four times a year, with one all-around annual review in March. This index is a capitalization-weighted index (just like the S&P500 index), and at each main annual review the weightings of each of the companies are capped at 15% and can range freely with share prices subsequently. Their weights are calculated with respect to the close price of the relevant companies on the 1st of March (every year).

Index Composition

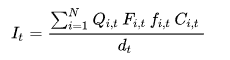

The index is comprised of a number of shares, of which the numbers are based on the constituent weights and index value at the time of readjustment.

This is the formula:

t – the day of calculation

N – the number of constituent shares in the index (usually 25)

Qi,t – the number of shares of company i on day t

Fi,t – the free float factor of share i;

fi,t – the capping factor of share i (exactly 1 for all companies not subject to the 15% cap)

Ci,t – the price of share i on day t

dt – the index divisor (a factor calculated from the base capitalisation of the index, which is updated to reflect corporate actions and other index changes).

Are you ready? Make your deposit today, start trading with as little as $250 and enjoy the benefits of trading with a regulated, Canadian broker!

Two other important indices on the Euronext Amsterdam are the AMX, inaugurated in 1995, derived from the Amsterdam Midkap Index and composed of 25 stocks on the exchange that are ranked 26-50 in size (where AEX represents 1-25 in size), and the AScX, inaugurated in 2005, reviewed quarterly and derived from the Amsterdam Small Cap Index. This second is composed of the 25 stocks that trade on the exchange and ranked 51-75 in size. The AScX is reviewed twice a year.

The factors influencing the overall index price of the AEX

The major market shock that hit the AEX index was the era of the dot-com bubble. This occurred in the late 1990s and saw a feverishly rapid rise in equity markets that was accommodated by investments in Internet-based companies.

During this time the value of all equity markets grew in huge quantities. The AEX reached 703.18 at the height of the dot-com bubble, only to experience the value being more than halved when the bubble burst.

Another large segment of the indexes composition is from the oil/energy sector. Consequently, oil markets have a particularly high influence on the performance price of the AEX.

The Royal Dutch Shell company, a British-Dutch multinational oil and gas company named one of the sixth largest companies in the world (measured in 2016 by revenue), accounted for 84% of the Netherlands’ $556 billion GDP in 2013. It is fair to say that when either oil or gas from other countries are impacted, the repercussions are directly related to the performance price of the AEX index.

Advantages of trading the AEX with Friedberg Direct

Start trading with Friedberg Direct, your trusted broker, and benefit from:

- Leveraged trading

- Free educational materials and webinars

- Technical support

- Selection of powerful trading platforms

Are you ready? Make your deposit today, start trading with as little as $250 and enjoy the benefits of trading with a regulated, Canadian broker!