SPAIN 35 – IBEX

| MT5/MT4 Symbol:SPAIN35 |

| Instrument:SPAIN 35 |

| Country:Spain |

| Currency:EUR |

| Exchange:MEFF |

| Trading Hours (GMT):07:00-18:59 |

An Overview of Spain’s Financial Engine – IBEX 35

The IBEX 35 stock market index represents the 35 most prominent and liquid companies on the Madrid Stock Exchange – Spain’s main exchange. It is calculated by the Sociedad de Bolsas, which is the company running Spain’s securities markets. The index is reviewed twice a year by the Technical Advisory Committee. This committee is made up of reps from the stock exchange’s derivatives market and professionals from the academic and financial fields. The companies are chosen based on their performance with the highest trading volume in Euros from the past six months. Once the liquidity has been appraised and securities have been measured, the committee takes into account a variety of factors and the top companies are included in the index.

A Brief IBEX 35 History

The IBEX 35 was established on January 14, 1992. During 2000-2007 the index was the strongest performer compared to many of its Westers counterparts. At the onset, economic growth helped keep the index strong; however, in January 2008 there was a downturn in the stock market, which created one of the biggest falls in the Spanish equity market. It rose again 3 days later.

The IBEX 35 is a free float capitalization-weighted index, like most European stock indices, including the DAX 30. This means that the index price is comprised of the components’ market capitalization multiplied by the free float factor (which can be anywhere between 0.1 and 1). Compared to many other European stock market indices, the IBEX35 does not have a weighting cap for the component stocks, meaning the highest market cap constituents have more influence on the index price.

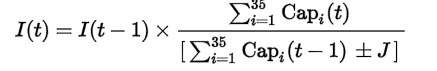

The IBEX 35 uses the formula below to calculate the index value

The top 5 companies on the IBEX 35 are:

- Inditex SA = Value: $109,467 million

- Banco Santander = Value: $107,055 million

- Bankco Bilbau Vizcaya Arge = Value: $57,445 million

- Telefonica = Value: $50,883 million

- Iberdrola = Value: $48,837 million

Factors influencing the overall index price are country-wide or sectorial economic shifts, trade agreements/embargo, industry-specific taxation or legislation changes, and significant shifts in the share price(s) of one or several of the major constituents.

A significant part of the IBEX 35 index composition is the banking sector; therefore, Forex trading markets have a particularly high influence on the index’s performance, as opposed to broader market indices like the S&P 500. The events that shake the stock market and influence the index price dynamics are political events, such as Grexit (Greece’s proposed exit from the EU), local elections, EU legislation issues, etc.

With the financial crisis that ripped through European markets, the index was also impacted by the news and fears of increased debts that were part of the Eurozone in 2007. There was also December 2013’s high unemployment rate of 25%. With the IBEX 35 being affected by European news, it can be a volatile instrument and provides some exciting opportunities to traders.

What makes IBEX an attractive asset

Like with all indices, the IBEX 35 is determined by economic conditions in Europe, and worldwide, geopolitical tensions and the performance of the companies included within the index. For example:

Economic conditions – When the economic conditions in Spain are good, the IBEX index seems to do very well.

Geopolitical Tensions – When global events are calm, the IBEX 35 does well. However, when there is a concern (like the 2001 terror attacks on the US), the IBEX tends to fall.

Online traders can use the IBEX 35 as a great opportunity to trade the instability in the Spanish markets. Many of the companies are from a specific industry, and by staying on top of these industries one can benefit and trade better overall with the IBEX 35.

IBEX 35 Trading information

- MT4 Symbol: IBEX35

- Trading Time: Monday: Friday 08:00 – 18:59

- Country: Spain

- Currency: EUR

- Minimum Trade Size: 1

- Increment: 1.00

- Exchange: MEFF

Advantages of trading IBEX 35 with Friedberg Direct

Start trading with your trusted broker and benefit from:

- Leveraged trading available

- Free educational tools

- Outstanding technical support service

Are you ready? Sign up today and enjoy the benefits of trading with a regulated, Canadian broker!.